Increasing IT costs in organizations makes it necessary to introduce appropriate control mechanisms for them. Frequently, especially in times of crisis, financial steering is based on commitments. On one hand, however, there is a risk that outstanding payment obligations will not be considered in a differentiated manner. On the other hand, the process of reconciling and determining commitments is complex and often not supported in practice, which can lead to errors, especially in decisions regarding possible savings potentials. However, IT has become an integral part of the value chain and leads to strategic competitive advantages. Therefore, efficient cost control, aligned with an organization’s priorities and strategies, should always be possible. Based on this premise, the following white paper introduces Bee4IT’s system-based rolling forecast. The paper will show how this approach covers the deficits of commitment-based financial management.

The Definition of Commitments and Their Use in Practice

The term ‘commitment’ refers to a company’s payment obligations and includes not only received and unpaid invoices but also future payment obligations. Commitments usually occur in purchasing and controlling (e.g., purchase requisition commitments, purchase order commitments, funds commitment, etc.) and companies release them when they receive goods or invoices or reduce reserved funds. In practice, a distinction is also made according to the account assignment object (order, cost center, and project commitments).

Commitments are used by cost center responsibles and project and service managers to identify purchase order financial buffers. IT controllers use commitments to analyze expected IT expenditures. Especially in economically challenging times, commitments are used to evaluate savings potentials. In such times, it is important to maintain operations and to stop or pause ongoing projects. Important questions are, therefore: 1) what is the commitment for operationally relevant RUN activities? and 2) how much can be saved from projects, or so-called CHANGE activities?

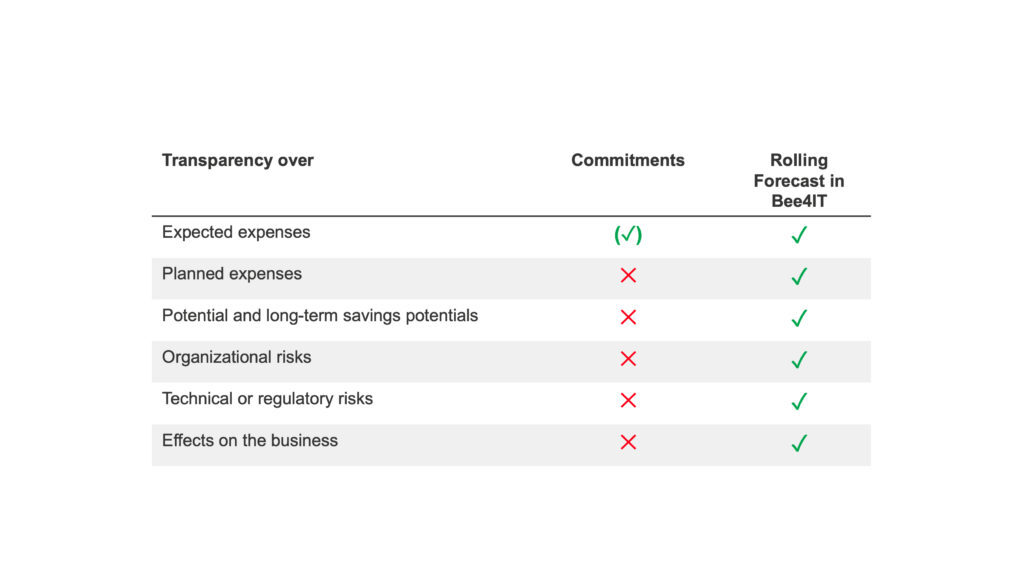

Commitments are merely intended to have a supporting function. After all, they only represent a part of reality and do not include all management-relevant information.

Why Commitments Only Represent Part of Reality

Order volumes are not fully exhausted:

Commitments for new suppliers:

Services provided but not yet invoiced:

Decentralized responsibility and obligation management:

High-quality, management-relevant information can only be collected in a decentralized manner, which means that cost center managers (department heads, team leaders, etc.) and those responsible for activities (project and service managers) who have the best knowledge regarding financial resources demand must provide the data. Now, this area is where the challenge lies. When managing commitments, purchasing, controlling, or financial accounting builds up and reduces funds. The quality of commitments therefore requires thorough coordination, which in practice is not always guaranteed and is subject to time delays.

The situation is further complicated by the fact that no additional decision-relevant information can be derived from commitments. The analysis of savings potentials can only be automated to a limited extent. For all projects, it is necessary to clarify. Which orders from projects have already been placed? Which are in the planning or approval process? Is it possible to stop current project orders? What are the contractual obligations? Is the IT department obliged to accept? Have services already been provided but not invoiced? Which expenditures serve the strategically important projects? Which expenditures guarantee IT operations? What is the progress of the individual topics? What are the internal service users’ specifications and priorities?

Before commitments can contribute to the decision-making process for savings, all these questions must be answered.

Why Commitments Only Represent Part of Reality Graphic Using Rolling Forecasts for Efficient Financial Management

Identifying savings potentials and efficiently using financial resources must not be viewed and practiced as a recurring exercise in difficult economic times, but as continuous discipline for the entire IT organization. The use of rolling forecasts¹ and decentralized management support the effective use of IT resources.

Rolling forecasts are continuously collected, adjusted and decentralized, which means that those responsible—such as project managers or service managers—immediately include new findings in the planning. Only management-relevant information is included, such as scope and scope changes, required financial and personnel resources, risks, and effects on existing enterprise architecture. Stakeholders are closely involved in the approval processes on a regular basis, which complies with the dual control principle and ensures the quality of the planning data. The planning format is consistent for all activities; the differences in the handling of RUN and CHANGE are only a matter of content and organization.

The continuous comparison of planned and actual data supports the rolling forecast. The responsible person can compare the planning with already-accrued expenses and reported times and adjust it accordingly. By reporting time from external partners in Bee4IT, one can estimate early on whether the planned support needs to be expanded.

Based on the rolling forecast, as well as on the IT strategy and initiatives transparently documented in Bee4IT, a data-driven discussion can take place to identify savings potentials at all levels of IT.

In the CHANGE area, it is necessary to re-examine—with the decision-makers for all strategic and regulatory projects—whether the changed environment (e.g., Covid-19) makes it necessary to implement the project. For all projects, it is necessary to evaluate how high the savings potential actually is. If projects do not require external capacities and expenditures, the savings potential can usually only be achieved by reducing the expenditures for internal staff. For all ongoing projects, it must be clarified whether completion is possible based on current progress. The identified projects must be stopped, and the capacities released by the discontinuation must be allocated to current projects in order to replace as many external capacities as possible. For all other projects in the CHANGE area, it must be determined how the implementation can be achieved with reduced effort. Decentralized responsible parties in business and IT have to be involved in this step.

In the RUN area, the question “How can expenses be reduced and operations maintained?” must be answered. In this area, it is important to note that expenses such as maintenance, licenses, and operation by third parties are usually long-term expenses. Here, too, it is important to check how the changed environment changes the operation. For example, are fewer licenses or devices needed in any departments? The business department is exposed to the same pressure to save funds and will want to reduce its IT costs. All investment decisions that have been made but not yet implemented must be examined to determine whether they can still be stopped. All external capacities must be examined to determine whether they can be covered by internal capacities. Job cuts will be difficult to justify if external capacities are tied up to a large extent.

Once the savings potentials in the portfolio have been identified, the IT organization’s expenditures must be examined more closely. How does the changed environment and the changed demand affect the IT organization? For example, in light of the Corona virus, travel costs and training costs for on-site trainings can be reduced across IT. It is necessary to evaluate whether external capacities can be reduced due to the changed demand and whether planned jobs may have to be cut.

The rolling forecast provides the necessary information and enables systematic and efficient financial management. The presented methodology is not only suitable in financially strained times; IT should adopt it permanently.

Why Commitments Can Still Be Appropriate

Companies that are currently at the early stages of the financial management maturity model and therefore cannot access the above-mentioned information should use commitments for more transparency. Please note, however, that this transparency is subject to the uncertainties mentioned above. Managers with high budget responsibility may also find it useful to provide transparency on order volumes, which allows follow-up orders to be triggered at an early stage.

Commitments represent only a part of reality. With the rolling forecast and the Bee4IT approach described above, reality is mapped holistically with current data, which can be collected and evaluated without time-consuming coordination.

References:

1. See Clausmark „Let‘s Roll: How Rolling Forecasts Enable Agile Financial Management”, Published: 23 September 2020

About the Authors

Sergej Neumann